Salve for the shock: a case for leadership on debt pause clauses

Author: Theodore Talbot

Illustration: Dulce Pedroso/Centre for Disaster Protection

In this insight, Theodore Talbot, our Chief Economist, delves into the increasing attention given to debt pause clauses. As the World Bank welcomes its newly appointed leader, Ajay Banga, this post explores the practical and philosophical considerations associated with multilateral lenders taking the lead in implementing pause clauses.

A debt pause clause – also known as a climate resilient debt clause, or a natural disaster clause –allows temporary halts in debt repayments during emergencies. The idea is gaining traction. Firstly, leaders are talking about them. Pause clauses are a key ask in both the Barbados-led Bridgetown Initiative and the V20 Accra-Marrakesh Agenda, supported by Ministries of Finance from more than 58 climate-vulnerable countries. Secondly, more big development lenders might offer them. Major multilateral development banks are convening a working group to examine whether—and how—to offer these instruments to clients. For a modest fee, the Inter-American Development Bank already offers a type of pausable loan. And the World Bank Group has made shock response a central pillar of its new strategy. And finally, the world might soon ask for them loudly. In the run-up to the Summit for a New Financial Pact in Paris, working groups on potential solutions will be looking closely at a range of clever financial innovations, including pause clauses.

What’s behind the growing attention?

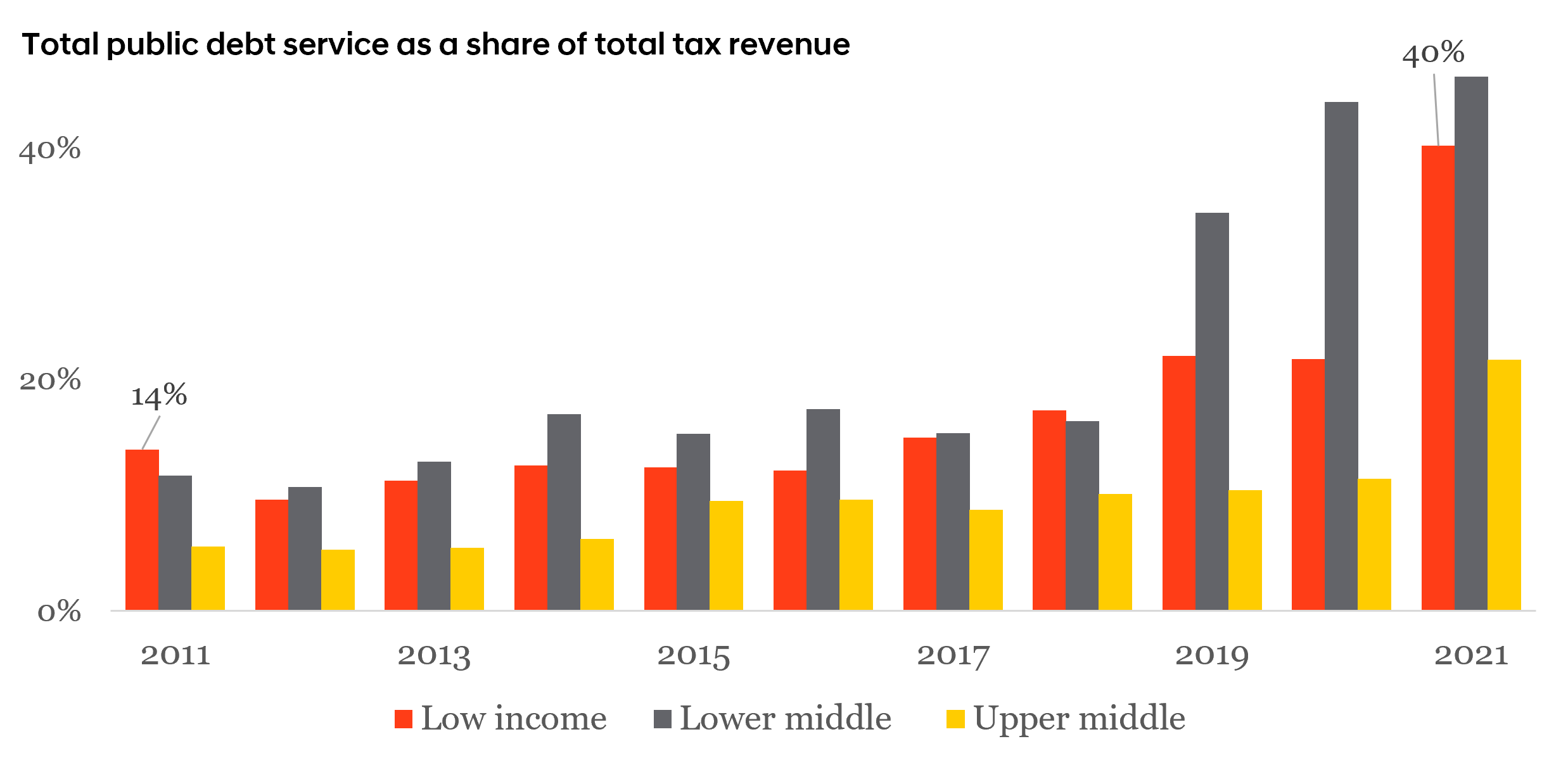

Countries have borrowed heavily to fund development. Past borrowing implies a current cost: repayments on public borrowing account for on the order of $4 in every $10 of tax revenue across low-income countries.

Paying off debt accounts for more and more tax revenue from lower-income countries

Total debt service on external public and publicly-guaranteed debt divided by total tax revenue for each group of countries in each year. Country classifications based on World Bank 2022 income classifications. Centre analysis of International Debt Statistics data.

This doesn’t make debt ‘bad’. When the returns to capital are high, it makes sense to invest more than we otherwise could. But when shocks like violent storms or disease outbreaks happen, debt payments are pinned down. Against a backdrop of growing debt service levels and increasing disaster risk, a pause clause enables countries to redirect funds to response efforts instead of debt payments.

Like any innovation, it is not without trade-offs and risks. As the world seeks effective financial solutions for both debt and climate risk, who should offer pause clauses? And what will it take to make them work well?

The case for development banks to lead

Former Mastercard CEO, Ajay Banga, assumed World Bank leadership in June 2023. Photo: Grant Ellis, World Bank

There is nothing, in principle, to prevent countries and the banks that help them issue bonds on global markets from seeking to add this feature to their borrowing. But as development finance experts have begun to assert, there’s a strong case for official and multilateral lenders to lead on offering pausable loans to clients. They can make this feature free at the point of use. They can offer more flexible triggers that accommodate a wider range of perils. And they have the mandate and the entry points to national policy dialogue to articulate effective money-out systems that turn freed funds into better protection.

Pricing

Would bond investors generally ask for higher interest rates on pausable bonds?

The Centre hosted a high-level roundtable on pause clauses, in part to dig into this topic. Bond pricing is complicated, but the answer was “probably,” for three reasons. First, the option to delay repayments is a valuable option, and valuable options aren’t free. Second, pausable loans would be novel, likely attracting a ‘novelty premium’ in the staid world of fixed income securities. Third, and relatedly, pausable debt would be “different” than more common bonds and so potentially harder to sell back into markets, generating a “liquidity premium.” The latter two frictions might be massaged away as pausable bonds become more common, but the first is a mechanical effect.

In contrast, multilateral development banks might choose to offer pausable loans (so no “novelty” concerns – it would be a policy decision). If they did, these are long-lived assets that the multilateral development banks (MDBs) hold until maturity and don’t sell (so no “liquidity” concerns). Moreover, if pauses are activated, the MDBs are more likely to have thick capital cushions to cover any temporary gaps in inflows (repayments from countries). Their balance sheets therefore provide a way to efficiently socialise the cost of pausable loans, and ideally providing this valuable feature ‘for free’ to lower-income countries.

Triggers

Triggers refer to the conditions under which a pause is activated. In the few real-world examples of pause clauses we’ve seen so far, they have been hammered out with a mixture of public and private creditors as part of a debt restructuring. In the case of Barbados, the option to delay repayment goes live if a sufficiently severe storm hits the country. Who decides what sufficiently severe means? In that case, it is whether the country gets a payout on its sovereign insurance policy from CCRIF SPC, a regional insurance company whose policy payouts are calculated based on external, verifiable data (like wind speed) and quantitative models of financial losses.

Alexi Chan, HSBC’s Head of Global Banking Sustainability, seemed to sum up the general private sector view on this topic in a panel at COP 27 when he noted that “clarity on the trigger points, full transparency, and the independent evaluation [of whether or not the trigger has been activated] is absolutely critical”.

Market players tend to seek triggers based on data because this allows them to estimate the likelihood the triggers are activated and because they are concerned about moral hazard.

While these so-called hard triggers are attractive, they are inflexible. If your house burns down, you don’t want your insurance to depend on whether the fire reached a pre-agreed temperature. As an example of this so-called basis risk, the World Bank’s Pandemic Emergency Financing Facility famously employed triggers that released funding too late to fund epidemic response effectively. As a result, it could not deliver timely funding to fight the spread of Covid.

Instead, pausable loans can borrow from insurance markets, which have solved the problems of activation and timing using policy, for example triggering based on declarations of national emergency. The lenders that are most likely to be able to offer this kind of flexibility of activation are the MDBs. Indeed, existing products already point the way. The World Bank’s Catastrophe Deferred Drawdown Option is a loan that can be activated based on a country’s declaration of a state of emergency.

Since many dissimilar shocks cause similar kinds of emergencies, flexibility is likely better for borrowers than anticipating the specific shock (and its measured intensity) they need to bake into a pause clause. Finally, the MDBs are well-placed to coordinate amongst themselves and harmonise the range of triggers in play—to maximise liquidity after disasters, countries will need a small number of flexible triggers covering a large share of their borrowing instead of different triggers for each loan they take on.

Money out

The poorest people in any society feel the most blowback from disasters. Pause clauses are a good way to get liquidity in the wake of “shocks” like heavy rains. But this liquidity, in turn, only protects people to the extent governments translate funding into action—what we call “money out.”

There are many examples. A recent evaluation of the African Risk Capacity, a sovereign insurer owned and operated by African governments, found that while insurance payouts triggered by likely drought risk arrived quickly, funds sat on government balance sheets for months instead of being pushed to vulnerable households right away.

Bondholders and private market participants could opt into pausable bonds. But they wouldn’t have the mandate or the ability to collaboratively build plans for what the government does with the money if the pause is activated. Paused repayments would stay on the government’s budget, to be used as it sees fit. In one sense, this is a feature. Countries are best placed to figure out what they need. In another sense, it is a bug. Without effective money-out systems, there are compounding risks that liquidity doesn’t translate into action or that the affected government’s actions leave poor and vulnerable people behind. This, again, is a risk the multilateral system is uniquely well-placed to address: it alone has the tools and the mandate to collaboratively build effective money-out systems with governments based on its explicit focus on preventing poverty.

Dilemmas and trade-offs

There are two related points against development lenders taking the lead on this innovation, one practical and one almost philosophical.

First, there is the practical point that global financial flows to countries with lower incomes per head look different than in past decades. In a world where low-income countries rely less on multilateral lenders, making multilateral lending pausable will create less liquidity.

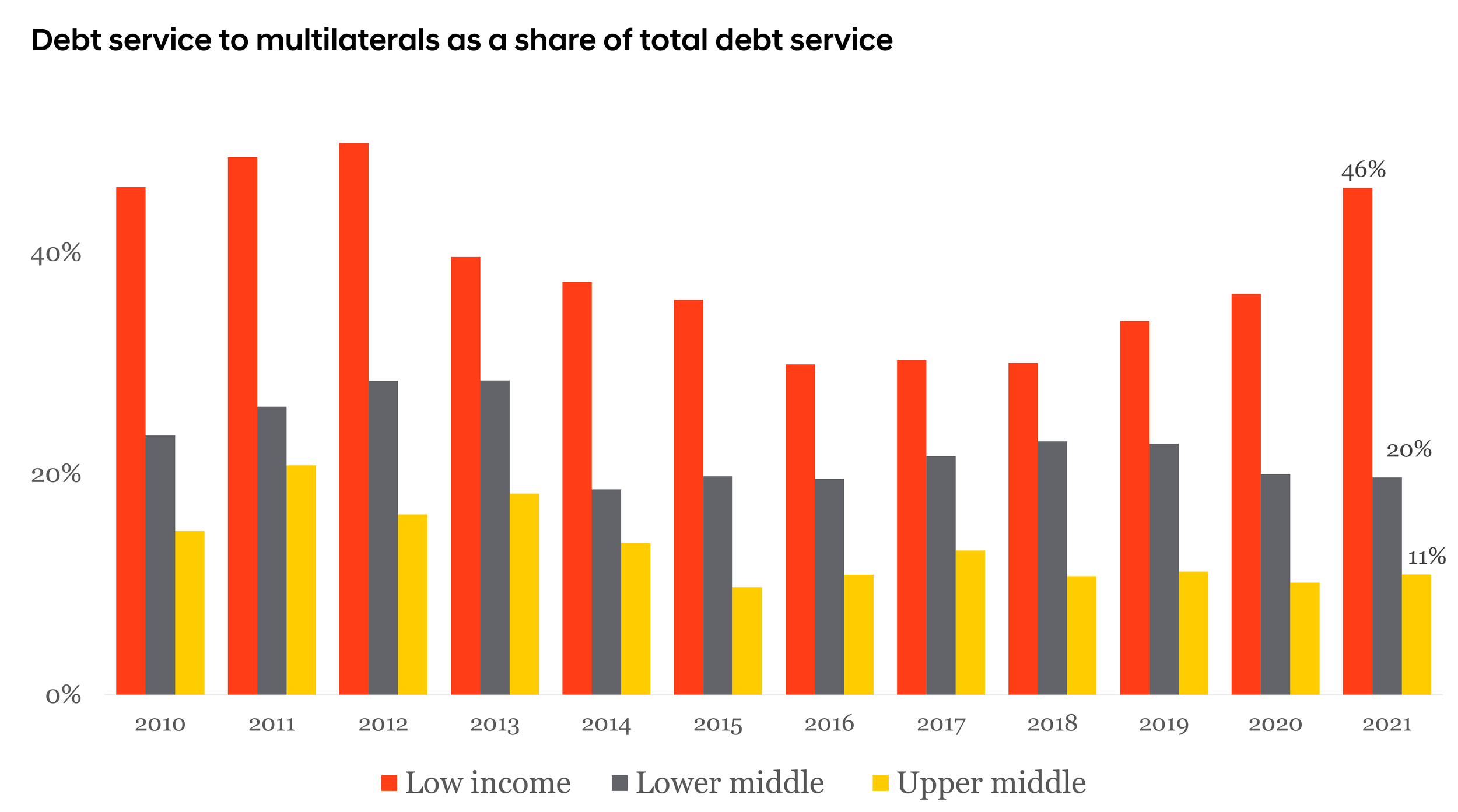

This is mechanically true, but it’s not correct to say that multilateral lending doesn’t matter. The figure below shows multilateral debt service as a share of total debt service on public and publicly-guaranteed borrowing (crudely: debt for which the government is on the hook). Countries still rely meaningfully on this type of financing, which accounts for about $4.6 in every $10 of repayments from low-income countries and around $2 in every $10 from lower-middle-income ones in 2021. An innovation that would affect between a fifth and half of total debt service would seem to be worth pursuing.

Total debt service to multilateral lenders divided by total debt service on external public and publicly-guaranteed debt for each group of countries in each year. Country classifications based on World Bank 2022 income classifications. Centre analysis of International Debt Statistics data.

This, in turn, begs the question: if the official creditors or multilaterals don’t charge more for pausable loans to compensate for the chance of occasional pauses, could this hurt them?

This has particular bearing for the MDBs, whose business models require them to maintain gold-plated triple-A credit ratings, underpinned by so-called preferred creditor status, a generalised expectation that these institutions get repaid before other lenders. Indeed, the possibility that rating agencies would take a dim view of temporary interruptions in repayments motivated MDBs to opt out of the Covid-era Debt Service Suspension Initiative.

Nailing this down requires peering into MDB balance sheets and funding operations, as well as making assumptions about the rate at which pauses would be activated and the extent to which activation would be correlated. Conceptually, though, if rating agencies review this idea and conclude the MDBs need a thicker capital cushion to enable pausable loans for free across large shares of their operations, the banks will have to choose some combination of:

tying up a bit of capital that would otherwise go to new loans for this purpose,

asking shareholders like the US or Japan for additional capital, or

allocating some of the freed-up capital from novel approaches like reinsurance that are now on the table towards enabling pausable loans.

If pausable lending carries some (potentially small) opportunity cost in terms of capital that can’t be used in other ways, the flexibility it buys for countries at risk would seem to be worth it. And, as we mention above and in more detail in our Insight Paper on this topic, development banks’ balance sheets would be a financially efficient place to socialise the cost of flexibility.

The bottom line

We at the Centre have been contributing to the design and analysis of this simple but important idea for nearly a year, including analytical work for a G7 working group, a high-level roundtable, and a recent paper.

As we gear up for another important policy moment in Paris this summer, it would be apposite for the MDBs and other official creditors to consider how they can announce specific, actionable, and timebound steps towards integrating this feature into their lending – without raising borrowing costs to client countries.

Doing so would provide these institutions with a clear response to growing calls for innovation in response to the climate agenda and accelerating disaster risk more broadly — a quick win when multilateralism could sorely use one. Coupled with effective money-out systems, this would enhance the protection we collectively provide after disasters to those least able to cope.