The future of pandemic financing: What can we learn from the Pandemic Emergency Financing Facility?

by Zoë Scott, Head of Multilateral Programmes, Centre for Disaster Protection

South Africa: Bloemfontein, 02 April 2020. The Bloemfontein branch of the South African Red Cross Society and the Department of Health in the Free State have set up a screening and testing mobile lab in Bochabelo, where volunteers help with temperature reading, medical history and assessing if the possible patient has been in close contact with covid-19. Photo: Moeletsi Mabe / International Federation of Red Cross and Red Crescent Societies

There has been a lot of media interest and discussion online about the World Bank’s Pandemic Emergency Financing Facility (PEF) in light of covid-19. The PEF was launched in 2017 and was an ambitious innovation, intended to help deliver finance to the world’s poorest countries if faced with a pandemic. The insurance window has now triggered for covid-19, which is good news, although the timing is far from ideal given that we know early action is the most effective approach when responding to disasters (more on timeliness and triggers in a future blogpost).

Planning in advance for crises and ensuring that there are cost-effective mechanisms in place to ensure that money can flow quickly and reliably after a disaster is so important, and yet it seems to be something that the world still hasn’t completely figured out.

For this reason, the Centre for Disaster Protection runs a free, open-to-all quality assurance (QA) service for anyone working on risk financing initiatives to help stop disasters devastating lives. The aim is to improve the quality (and ultimately quantity) of disaster risk financing.

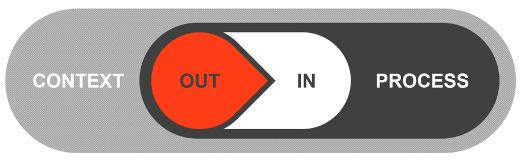

Our QA approach is premised on the idea that there are four elements of disaster risk financing that it is important to get right:

A. Context – is it suitable for the broader context e.g. is there broad ownership in the country, does it fit with existing strategies to manage priority risks and needs, is it sustainable?

B. Money-out systems – how will the money be used to reduce the impact of a disaster on the most vulnerable people?

C. Money-in instruments – how reliable and accurate are the financing instruments to ensure that the right amount of money is provided at the right time?

D. Project management processes – are practical considerations covered, for example, is there adequate capacity, are timescales appropriate, are there more cost-effective alternatives and are there systems for monitoring and evaluation?

We don’t have access to the necessary information to fully answer these questions and conduct a retrospective QA review of the PEF, so instead this blogpost highlights four factors that often get overlooked, but we think are very important for making sure that risk financing works well. We discuss how the PEF handled each and what could be done differently in future. The PEF matures in mid-July and the international community is already thinking about future approaches. What improvements does our QA approach suggest should be made for the next, genuinely fit-for-purpose pandemic financing?

1) Getting money ‘in’ is only half the issue—don’t forget to plan how to get money ‘out’ to the people who need it most, when they need it

When designing risk financing, there is a temptation to focus on financial instruments: insurance, contingent credit, bonds etc. How the money comes ‘in’ is obviously important because it impacts on how quickly finance can flow, what proportion of needs can be met, and with what predictability. But getting money ‘out’ to the people who need it, when they need it, is just as important. If that hasn’t been thought through properly, ahead of time, then responses can be slow, badly targeted and not as effective as they had the potential to be. Money for crises like droughts or economic shocks can get ‘out’ to affected households through cash transfers and social protection programmes. This is useful for combatting the economic impacts resulting from pandemics, but for the health shock itself, money needs to be targeted at health systems i.e. service delivery at the sovereign level.

The PEF did think about how to get money out. It developed an operations manual, which was created with input from experts with experience in health operations, as well as those who know the considerable challenges of channelling money through delivery systems in low- and middle-income countries. Following the Ebola outbreak in 2019, when the PEF’s cash window disbursed money, the Democratic Republic of Congo had to submit a clear response plan and specified implementing arrangements with their request for funds.

So, this is a good start. But is it possible to go further in future? We have all learned over the last few months that operational decisions made in the heat of a crisis are often not the best. Ideally, response plans are made well in advance, as part of a broader preparedness plan, pre-agreed with relevant agencies and just tweaked when a crisis actually starts to unfold and the money starts to flow. Ideally, triggers should trigger action plans as well as finance.

Some other risk financing initiatives do this: the African Risk Capacity, for example (a sovereign drought insurance scheme from the African Union), insists that countries wanting to buy insurance have to have an official contingency plan (reviewed by a technical committee) before they can purchase a policy. The point of planning ahead isn’t just to facilitate how payouts are used; they function as an important tool for initiating preparedness and capacity-building.

This highlights a difficult trade-off: do you focus on ensuring careful preparedness and early planning at the country level, or go for scale? PEF chose scale—presumably deciding it would be better to cover all 76 IDA countries, rather than scaling back on that ambition in order to add in the complexity of preparedness and early planning in each country. In future, would it be possible to find a middle ground where scale is balanced with incentivising a level of preparedness and planning? Could regional approaches and organisations get more traction? This would allow for a tighter focus on risks most relevant to the region, allowing for greater country-specific preparedness work and cross-border co-benefits.

2) Make sure that you will reach the poorest and most vulnerable people as they need the money most

Pandemics are like most disasters: they disproportionately impact the poorest people. It is therefore appropriate that pandemic finance should prioritise the poorest countries or regions. PEF does this to a certain extent in that it is accessible only for IDA countries (i.e. countries with a GNI per capita below a certain level—US$1,175 in fiscal year 2020). However, this is a large group, including some middle-income countries such as Pakistan, Nigeria, and Kenya, which have much better health systems and access to finance than the very poorest countries.

It is not yet clear how the payout from the PEF’s insurance window for covid-19 will be allocated amongst countries. The operations manual states that, for a non-flu event, allocations will be based on a combination of the number of cases and population size. The number of cases would be based on WHO reported cases as at 31st March 2020—the date the payout was triggered. The risk of using this approach is that countries that did not have a high number of confirmed cases on 31st March (e.g. most African countries) may see very sharp increases in the coming weeks. The PEF’s Steering Body may therefore choose to use the flu allocation criteria for the covid-19 payout instead (although it is not a flu, covid-19’s rapid global spread is similar to what was expected from a flu outbreak and the operations manual allows some discretion). If this approach is followed, money will be allocated based solely on the population size on a first come, first served basis. The problem with this approach is that very poor and badly affected small countries would get less support than large, less affected and wealthier countries. As the total amount triggered is only US$195 million, it remains to be seen how many of the very poorest countries will get a slice of the pie before it is all gone.

Perhaps the PEF’s Steering Body could try a different approach and incorporate a consideration of comparative poverty levels when deciding how to allocate the payout? Or it could take into account the country’s existing health infrastructure or ability to finance a response through other means? In future, pandemic financing could seek to make allocations more needs-driven by incorporating these sorts of approaches.

3) Open up and learn from mistakes

It is often only as a project is being implemented, or even afterwards in hindsight, that we can see clearly how it could be improved. This is the point of monitoring and evaluation (M&E) work in the development sector: to check that things are working as was expected; where possible make on-going adjustments so outcomes get better and better; open initiatives up to independent scrutiny; and be prepared to let our own shortcomings contribute to global learning. Unfortunately, most disaster risk financing fails to embed M&E, and we need to start doing this much better.

The PEF was an innovation in many ways—it was the first attempt to use insurance to pay for pandemic risk on behalf of the world’s poorest countries. It used complex triggers and sophisticated financing arrangements to try to better the chances of poor countries in the face of a variety of diseases. It is therefore inevitable that, with the benefit of hindsight, commentary is now emerging on how it could be improved.

The PEF has been more transparent than most risk financing initiatives, for example the operations manual and investor manuals are both online. This level of transparency should be applauded and adopted across all actors in disaster risk financing initiatives. That said, the documents themselves are extremely complicated, which does rather limit the intended transparency.

But can the PEF go further with accountability and transparency? Donors could commission a retrospective, independent evaluation of the PEF, or at the least an independent recording of lessons learned would be very helpful to inform future thinking.

4) Involve the people who matter: work with governments and communities to manage risks

There are many reasons why we need to ensure that at-risk countries (governments and civil society) are meaningfully involved in the design and implementation of risk financing. Firstly, it builds sustainable risk ownership and capacities to manage risks where they are actually being experienced. Secondly, involving country governments and at-risk communities in the design and implementation of risk financing typically improves the technical effectiveness and operational feasibility of initiatives. Details matter with risk finance and financing ‘solutions’ must be appropriate for the context.

There is not much information publicly available as to whether, how and to what extent the PEF consulted with governments in IDA countries during the design phase. The World Bank’s approach is normally to work closely with governments, but the PEF was set up as a separate facility and so we cannot assume that this took place. Some feel that it didn’t take place adequately enough, but there are some indications of engagement e.g. two seats on the PEF Steering Body are reserved for IDA countries (currently Haiti and Liberia). Without more information from the PEF (or an evaluation!) we will never know. We do know that the long-term intention of the PEF was for governments to take over the cost of paying premiums—for this to realistically happen there would need to be a clear engagement process.

Risk financing of the future has to involve meaningful engagement with governments and at-risk communities. Future pandemic financing should ensure that governments are fully engaged and on-board from the beginning to help ensure proposed approaches are practically feasible, contextually relevant, and politically sustainable.

As we can see, the PEF did some things well but there is room for improvement and clear lessons to learn for the future. Much of the risk financing in the world today overlooks these four important factors, but there are some positive examples of change happening which we will cover in future blogposts. We can all do better, and at the Centre through our QA service we will keep pushing for all types of risk financing, including for pandemics, to better reflect these four factors for quality disaster financing.

The Centre’s Glossary of Terms can be found here.